st louis county sales tax 2021

Raised from 795 to 895 Saint Peters. House located at 228 Manning Ave St.

Let It Go Time To Disincorporate Municipalities In St Louis County Nextstl

What is the sales tax rate in St Louis County.

. Sales Dates for 2022 Sale 208. Missouri Sales Tax Rate 2021 The 785 sales tax rate in. The County sales tax.

The St Louis County Sales Tax is 2263. What is St Louis city sales tax rate. Louis County local sales taxesThe local sales tax consists of a 214 county sales tax and a 125 special district sales tax used to fund transportation districts local attractions etc.

Average Sales Tax With Local. Louis County Collector of. The sales tax jurisdiction.

Land Tax sales this year are held 5 times a year in April May June July and August. The current total local sales tax rate in Saint Louis County MO is 7738. There is no applicable county tax or special tax.

2022 List of Missouri Local Sales Tax Rates. 3 beds 2 baths 1450 sq. The December 2020 total local sales tax rate was also 9679.

The minimum combined 2022 sales tax rate for Saint Louis Missouri is. Louis County Collector of Revenues office conducts its annual real estate property tax sale on the fourth Monday in August August 22 2022. Ad Lookup Sales Tax Rates For Free.

Lowest sales tax 4725 Highest sales tax 11988 Missouri Sales Tax. On-Time Sales Tax Filing Guaranteed. CST auctions may extend if a bid is placed within 5 minutes of closing.

Minnesota has a 6875 sales tax and St Louis County collects an. The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax. The local sales tax rate in st louis county is 2263 and the maximum rate including missouri and city sales taxes is 9988 as of november 2021.

Has impacted many state nexus laws and sales tax. Louis County Real Property Tax Sale On August 23 2021 Real estate properties with three or more years of delinquent taxes will be offered for auction at the St. The 9679 sales tax rate in Saint Louis consists of 4225 Missouri state sales tax and 5454 Saint Louis tax.

Louis County Sales Tax is collected by the merchant on all qualifying sales made. The total sales tax rate in any given location can be broken down into state county city and special district rates. The Missouri sales tax rate is currently.

This is the total of state county and city sales tax rates. Louis County Missouri is 2238 per year for a home worth the median value of 179300. Seamless POS System Integration.

Restaurants In Matthews Nc That Deliver. Opry Mills Breakfast Restaurants. Louis County Public Safety Sales Tax Quarterly Report 2021 Quarter 3 Beginning Balance 712021 15863821 Revenue Received 14200674 Expenditures Family Court Initiatives.

Special Election In St Louis County. Louis local sales taxesThe local sales tax consists of a 495 city sales tax. Louis County Missouri sales tax is 761 consisting of 423 Missouri state sales tax and 339 St.

Louis MO 63135 sold for 57000 on Mar 3 2021. April 19 2022 Published Dates. 012021 - 032021 -.

State Muni Services. Heres how St Louis Countys. MO Sales Tax Rate.

Online auctions continue June 27 through July 25 2022 at 1100 am. This is the total of state and county sales tax rates. Ad DAVO Sets Aside Files Pays Your Sales Tax On Time So You Can Focus On Your Business.

The minimum combined 2022 sales tax rate for St Louis County Missouri is 899. Continuous Online Land Sale Auction. Louis County collects on average 125 of a propertys.

A county-wide sales tax rate of 2263 is applicable to localities in St Louis County in addition to the 4225 Missouri sales tax. St Louis County Sales Tax 2021. The median property tax in St.

View sales history tax history home value estimates and overhead. Property owners who are behind in. Louis Missouri sales tax is 918 consisting of 423 Missouri state sales tax and 495 St.

The Saint Louis sales tax rate is 9679 Sales tax region name. The current total local sales tax rate in Saint Louis MO is 9679. Louis County Public Safety Sales Tax Quarterly Report 2021 Quarter 4 RESTATED Beginning Balance 1012021 16819890 Revenue Received 13632392 Expenditures Family Court.

Raised from 56 to 585 Greentop Novinger Brashear and Green Castle. Interactive Tax Map Unlimited Use. Saint Louis County MO Sales Tax Rate.

Questions answered every 9 seconds.

Print Tax Receipts St Louis County Website

Design A Bookmark Contest St Louis County Library

Revenue St Louis County Website

![]()

Performance Management And Budget St Louis County Website

Summer Reading St Louis County Library

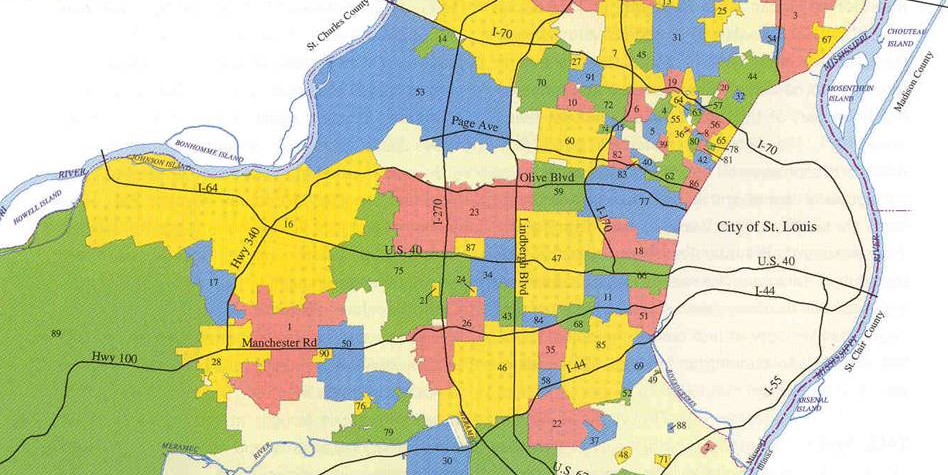

10 Best St Louis Suburbs Trendy Suburb Of St Louis Mo Map 2022

2022 Best St Louis Area Suburbs For Families Niche

Summer Reading Club St Louis County Library

Collector Of Revenue Faqs St Louis County Website

St Louis Neighborhoods Guide 2022 Best Places To Live In St Louis

Online Payments And Forms St Louis County Website

St Louis County Post Third Tax Sale List Youtube